What is Ea Form Malaysia

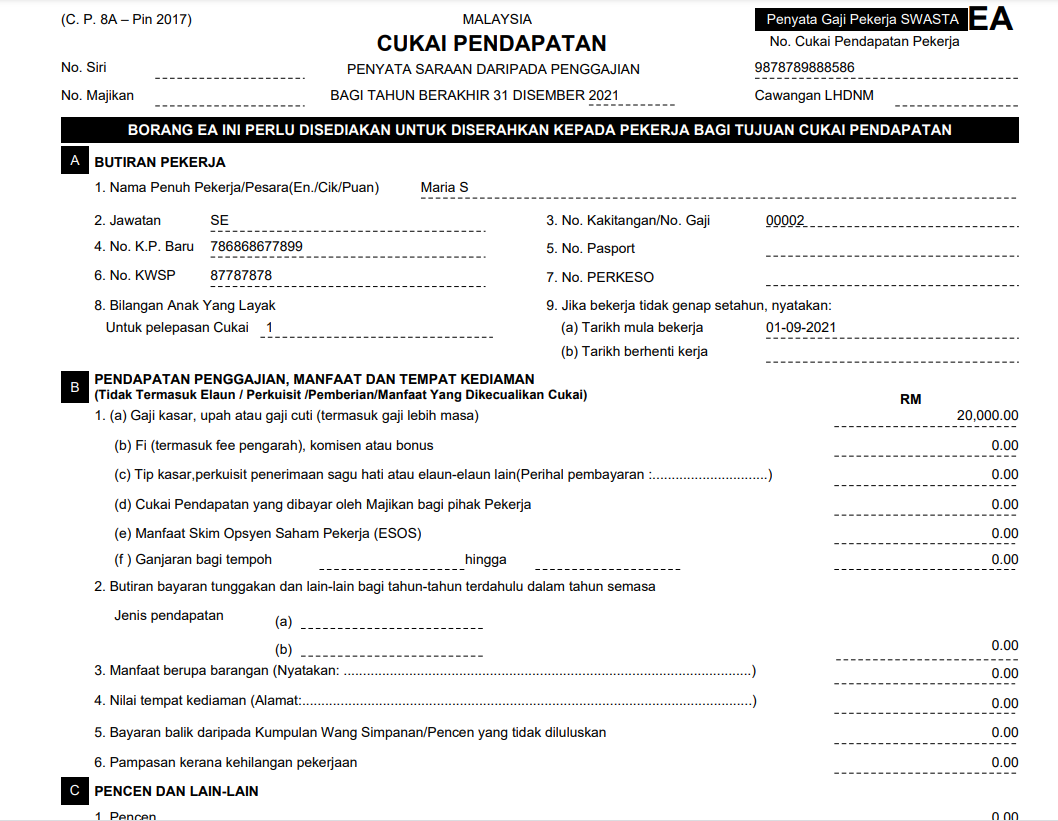

In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

This activity facilitates the preparation of Form EA for the employees to submit their Income tax returns.

. The freelance market in malaysia has seen substantial. Many of the Income Tax related forms are quite difficult to find. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year.

What is EA form in Malaysia. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. Part F of Form EA is where you can file for tax exemptions on certain perquisites and benefits-in-kind thereby reducing your overall chargeable income.

EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in. Is EA form compulsory. When you do your annual e-Filing at LHDN.

This activity aids in the production of Form EA which is used by workers to file their income tax returns to the Internal Revenue. For YA 2021 please do ensure that you employers must issue Form EA to your employees by 28 February 2022. Governed by the Income Tax Act 1967 Section 831A the latest EA form in Malaysia shall be prepared and provided to employees for income tax purposes.

According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. Furthermore youll want to ensure that you file the form online. Latest salary statement eaec form or pay slip.

Form EA form is issued by the Inland Revenue Board of Malaysia to be completed by employer in reporting the total remuneration paid to each and every employee for every assessment year. The EA form is a Yearly Remuneration Statement that includes your salary for the past year. In Part F of Form EA you could file for certain tax exemptions that.

In Part F of Form EA you can file for tax exemptions for certain benefits-in-kind that can reduce your. You will need to refer to this to file personal taxes during tax season. It is used for ea tax form for malaysia rpcteal0 this report generates the following forms to be filled in by the employer for filing annual income tax.

What is Form EA. E-Filing starts from 1st March to 30th April of every year. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. A quick guide to file your malaysian personal income taxes especially for new. Our Customer Success Manager Julian answers top questions for employers who are not familiar with the nitty gritty of EA form including- What is a EA form.

The Inland Revenue Board of Malaysia has released Form EA which must be completed by the employer in order to record the total remuneration given to each and every employee for each and every assessment year. What is Form EA. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year.

It is the obligation of employers in Malaysia to generate or prepare Form EA for employees e-Filing before March of every year. We have located the specific links to these forms for easy download. The EA form could be simply explained as a yearly remuneration statement from employment which is also known as the CP8A form.

For everyone who has no idea what EA forms are let us break it down for you.

What Is Form Ea Part 1 Defining The Benefits In Kind

St Partners Plt Chartered Accountants Malaysia Form Ea 2020 Statement Of Remuneration From Employment For Private Sector This Form Ea Must Be Prepared And Provided To The Employee

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

No comments for "What is Ea Form Malaysia"

Post a Comment